income tax rate malaysia

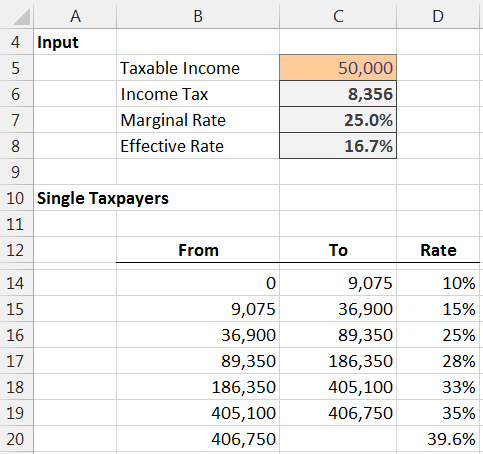

0 to 5000 Tax rate. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards.

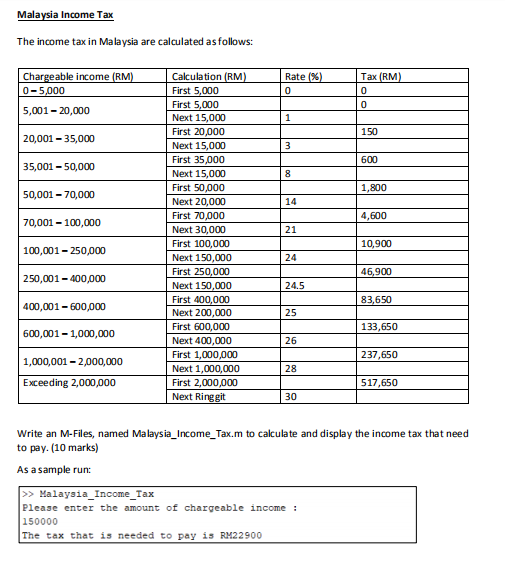

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

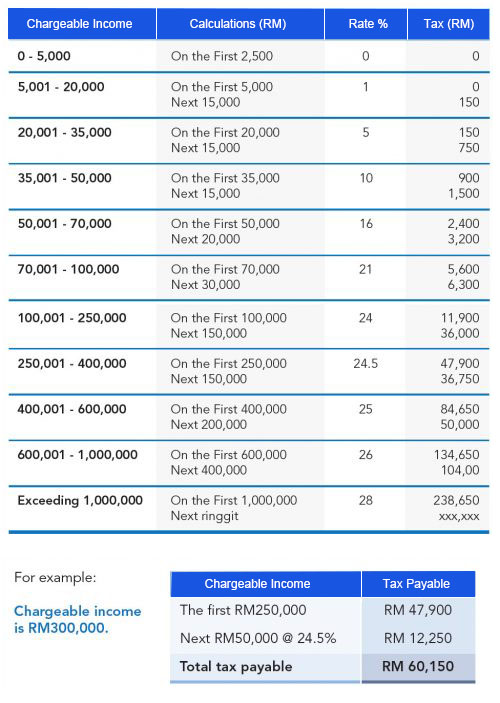

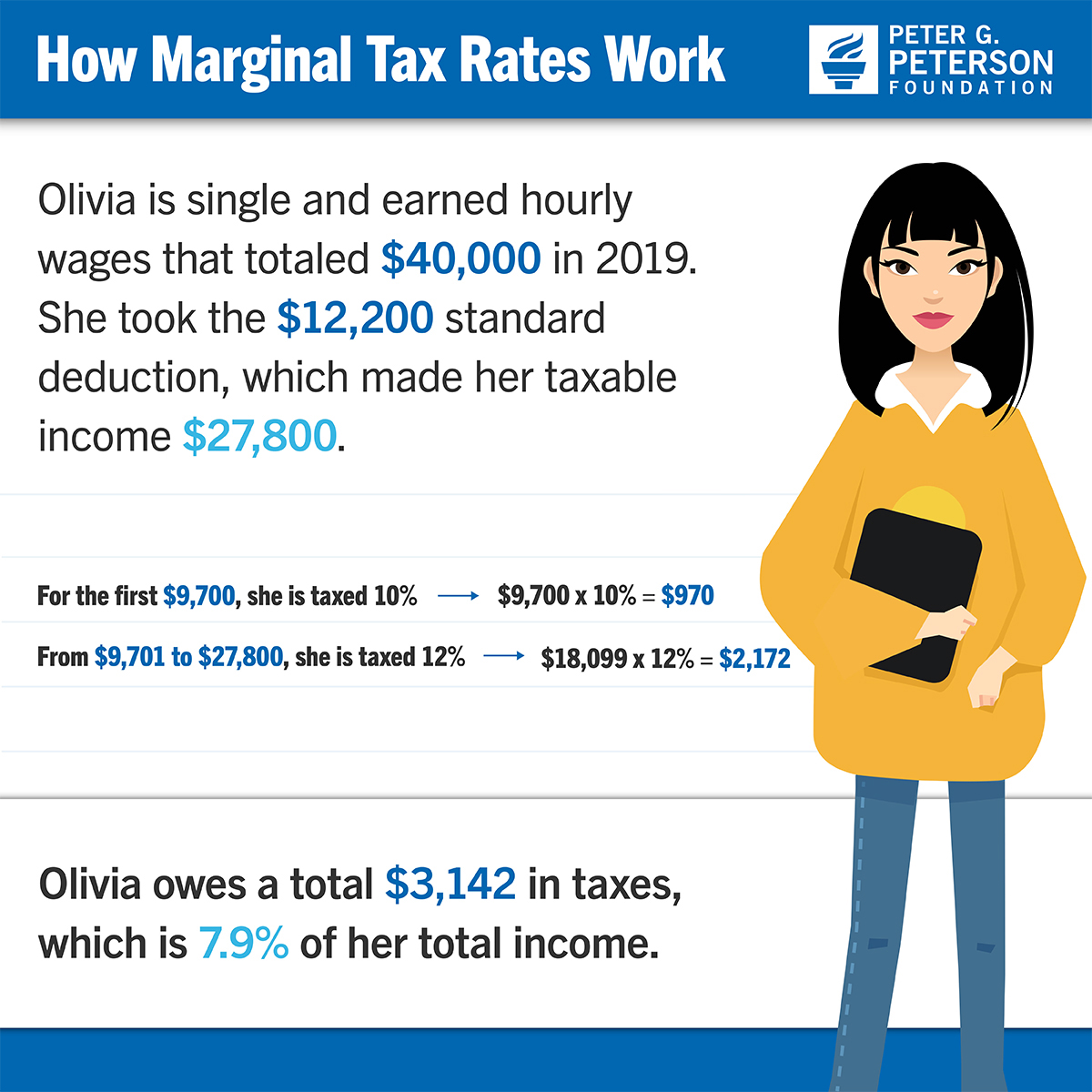

. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. Your tax rate is calculated based on your taxable income. So the more taxable income you earn the higher the tax youll be paying.

To figure your tax rate from this table you first need to identify your taxable income defined as taxable income minus any tax deductions and exemptions. You can check on the tax rate accordingly with your taxable. Malaysia Monthly Salary After Tax Calculator 2022.

The War on Poverty embraced expanding the federal governments roles in education and health care as poverty reduction strategies and many of. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Last reviewed - 13 June 2022. Income Tax Rates and Thresholds Annual Tax Rate. Per LHDNs website these are the tax.

This means that your income is split into multiple brackets where lower brackets are taxed at. Taxable income band MYR. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

On first RM600000 chargeable income 17. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. However the blended tax rate is much lower for most residents.

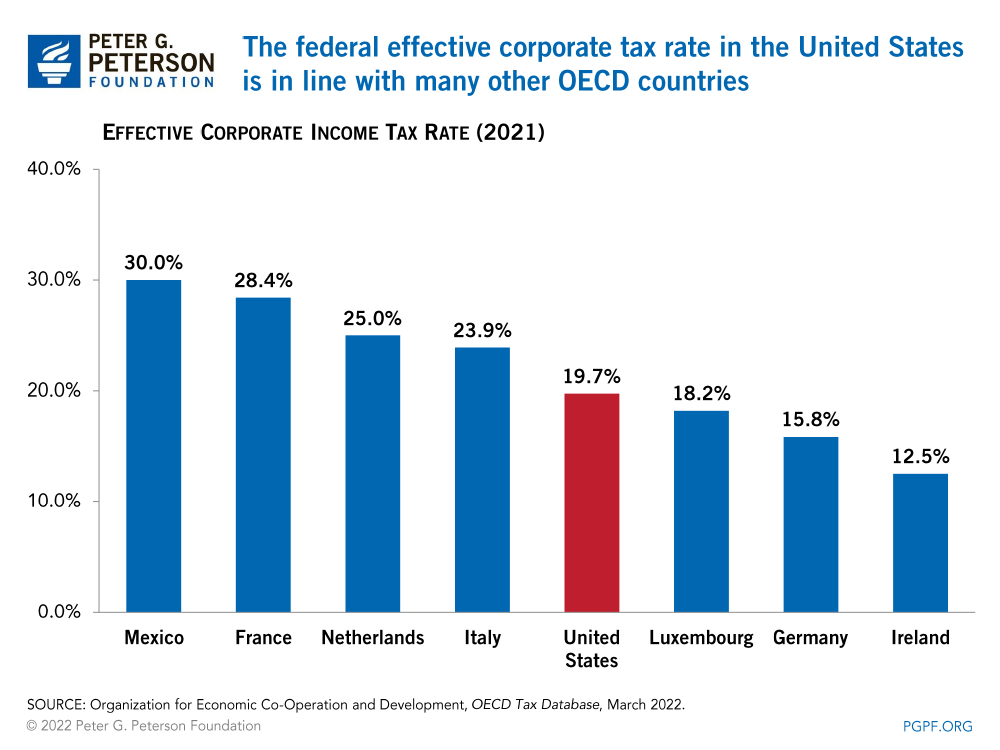

Our calculation assumes your salary is the same for 2020 and 2021. Income Tax Rates and Thresholds Annual Tax Rate. Corporate - Taxes on corporate income.

Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The median monthly income for Malaysian households continued to grow in 2019 albeit at a. Malaysia Non-Residents Income Tax Tables in 2022.

You must pay taxes if you. 2020 income tax rates for residents. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

ITA enforces administration and collection. 13 rows Malaysia Residents Income Tax Tables in 2020. For both resident and non-resident companies corporate income tax CIT is imposed on income.

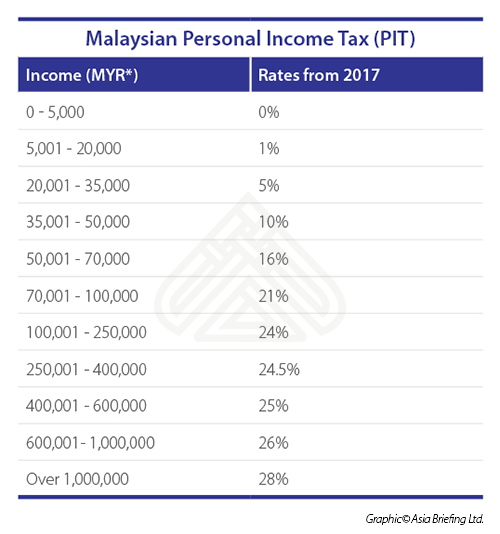

Personal Income Tax Rates. However if you claimed RM13500 in tax. 0 Taxable income band MYR.

Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases. Taxable income band MYR. Tax Rates for Individual.

Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million.

What Is The Difference Between The Statutory And Effective Tax Rate

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

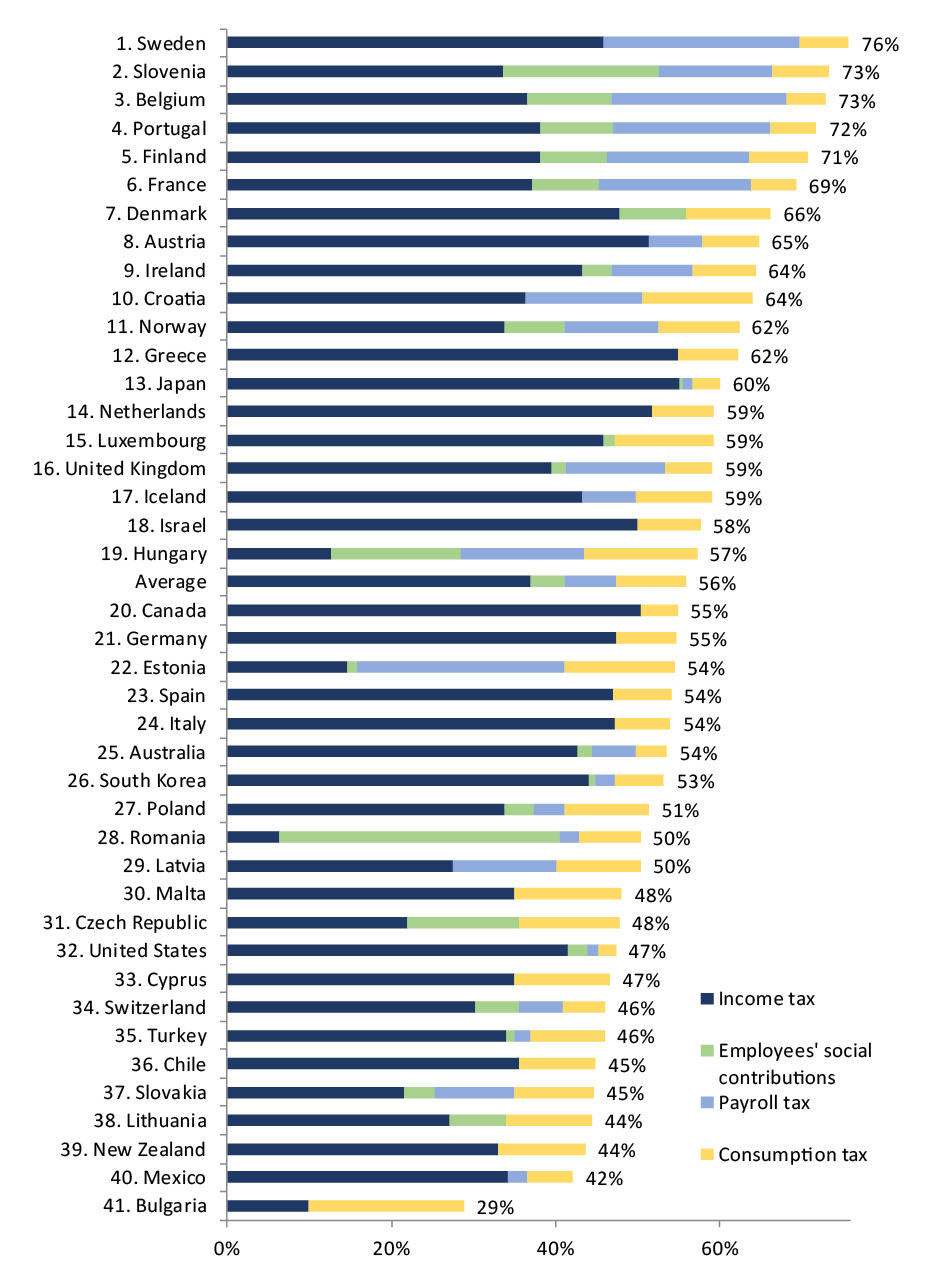

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

Corporate Tax Rates Around The World Tax Foundation

Malaysian Personal Income Tax Pit 1 Asean Business News

Tax Rates In Selected Countries Download Table

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Income Tax Formula Excel University

Understanding Tax Smeinfo Portal

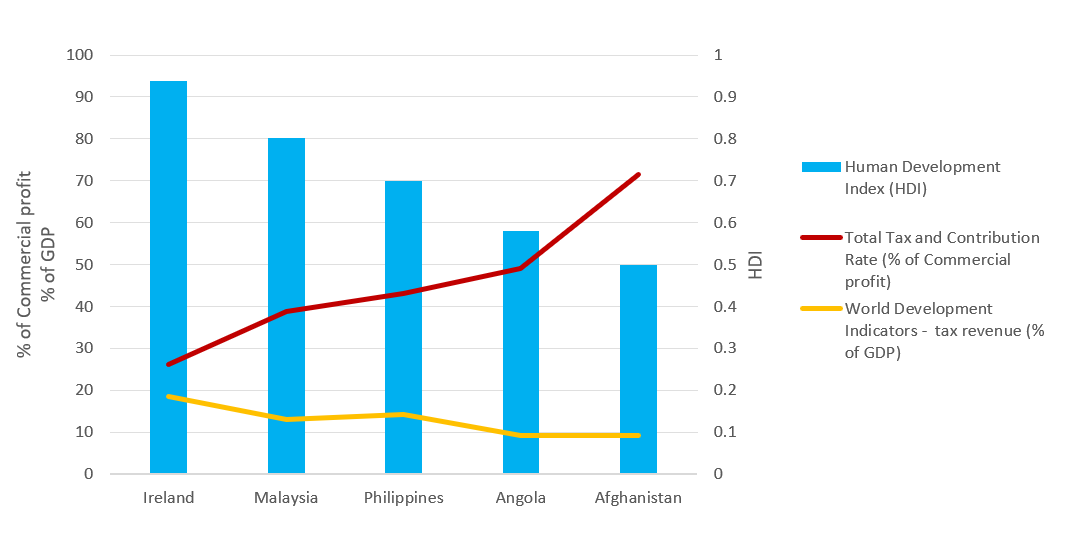

Why It Matters In Paying Taxes Doing Business World Bank Group

تويتر Ja Del Rio على تويتر Our Partner Shinewingtyteoh Shared With Us The Following News 0 Corporate Income Tax Rate Up To 15 Years For Foreign Direct Investment Fdi

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Tax Guide For Expats In Malaysia Expatgo

What Is The Difference Between The Statutory And Effective Tax Rate

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Why No Wealth And Inheritance Tax In Malaysia R Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

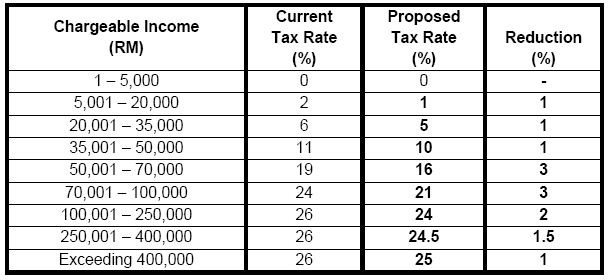

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News